It is no secret that traditional knowledge of accounting is no longer sufficient to meet the demands of modern companies. This is where the IFRS certificate stands out as a factor that makes the difference between an accountant who performs daily tasks and a professional with a global perspective and advanced analytical abilities in preparing financial reports. With the adoption of international financial reporting standards (IFRS) in Saudi Arabia and the Gulf countries, this certificate has become one of the most powerful tools that give you a competitive edge in the job market.

In this article, we practically explore what the IFRS certificate from ACCA is, why it enjoys wide international recognition, the key benefits it brings to your career, its importance in the Saudi market, and how to obtain the certificate step by step. We will also highlight the groups that benefit the most from it, job opportunities after obtaining it, and why choosing an accredited training provider is crucial for success.

If you are aiming for career advancement, increasing job opportunities, or building a more stable financial future, keep reading to discover how this certificate can be a turning point in your professional journey.

What is the IFRS Certificate from ACCA?

When discussing the benefits of the IFRS certificate, it’s essential to first understand what this certificate is, especially when it is issued by a prestigious international body like the Association of Chartered Certified Accountants (ACCA). The IFRS certificate from ACCA is one of the leading professional programs specializing in international financial reporting standards. Its goal is to equip accountants with a deep understanding of the conceptual framework of these standards and the ability to apply them professionally in various work environments.

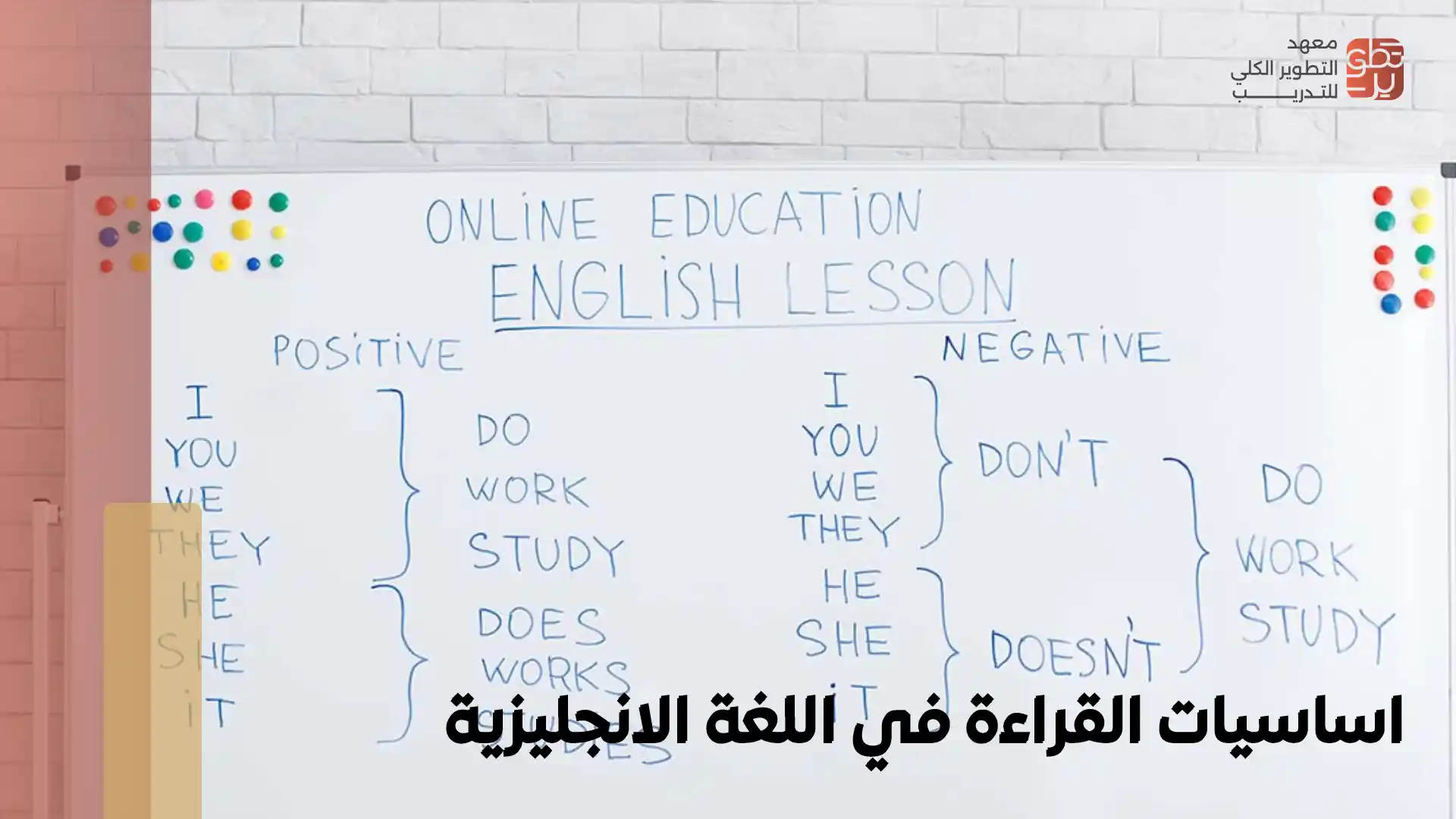

The IFRS certificate from ACCA focuses on the practical aspects of the standards, such as how to recognize revenues, handle financial instruments, prepare consolidated financial statements, and deal with assets and liabilities according to the latest international updates. This applied focus highlights one of the significant benefits of the IFRS certificate, as it is not limited to theoretical knowledge but extends to practical application that businesses require.

This level of recognition and widespread adoption clearly shows why the benefits of the IFRS certificate are closely tied to professional excellence, particularly for those working in environments where high accuracy in financial reporting is required. Understanding the nature of the certificate gives you a clearer view of what it can add to your career path and paves the way for advancing to a higher professional level in accounting and finance.

Benefits of the IFRS Certificate That Enhance Your Career

When reviewing the benefits of the IFRS certificate, we find that it goes beyond just obtaining a professional certification; it represents a real investment in your future career. With international standards being adopted in many countries, this certificate has become a qualification that distinguishes a professional accountant from others.

Here are the key benefits of the IFRS certificate that directly impact your career path:

- Enhanced job opportunities in large companies: Publicly traded companies and multinational institutions seek professionals with a deep understanding of international standards, making the certificate holder more competitive in the job market.

- Increased trust in financial reports and analysis: Having specialized knowledge in international standards increases management and investor confidence in the accuracy of your reports and financial analysis.

- Career advancement: Many senior financial management positions require knowledge of international standards, and the IFRS certificate qualifies you to take on greater responsibilities.

- Improved ability to analyze financial statements: Studying international standards enhances your ability to read and analyze financial statements in depth, which helps in making more accurate financial decisions.

- Adaptability to changes in accounting and legislative standards: As international standards evolve, having this certificate makes you more capable of keeping up with professional updates.

These aspects show that the benefits of the IFRS certificate are not theoretical; they are practical and direct, impacting every stage of your professional development. As competition increases in the job market, specialized knowledge becomes a decisive element for success and job stability.

Importance of the IFRS Certificate in the Saudi Market

The benefits of the IFRS certificate are clearly evident when looking at the nature of the Saudi market, which is experiencing continuous growth in the financial and investment sectors. The adoption of international financial reporting standards in publicly listed companies and many large institutions has made familiarity with these standards a professional necessity.

In Saudi Arabia, the demand for specialists capable of preparing financial reports compliant with international standards is increasing, especially due to:

- The expansion of foreign investments.

- The growth of startups and large companies.

- Increased mergers and acquisitions.

- Enhanced transparency and financial disclosure.

All of these factors strengthen the importance of the IFRS certificate in the local context, as it provides holders with a clear competitive advantage in the Saudi market. Furthermore, financial institutions, banks, and consulting firms prefer to hire professionals with experience or training in this field.

Moreover, the ambitious economic transformations in Saudi Arabia further support the need for financially qualified professionals with global standards. Therefore, obtaining a specialized IFRS certificate is a strategic step for anyone seeking to build a stable and prosperous career within the Kingdom.

How to Obtain the IFRS Certificate Step by Step

To make the most of the benefits of the IFRS certificate professionally and effectively, a clear path must be followed, starting with proper planning and ending with successfully passing the exam. The most common path to obtaining this certificate is through the IFRS diploma offered by the Association of Chartered Certified Accountants (ACCA), an internationally recognized body in accounting and finance. Here’s how you can obtain the IFRS certificate:

- Choose the right awarding body: The first step is to select the organization that will award you the certificate. The IFRS certificate from ACCA is one of the most popular options due to its professional value and international recognition.

- Register for the exam: Create an account on the ACCA platform and apply for the IFRS diploma, then choose an exam date from the available slots throughout the year.

- Pay the exam fees: After registering, you must pay the required fees to confirm your exam seat, which is a necessary step in completing the application process.

- Prepare academically: The IFRS certificate requires thorough preparation, including studying the conceptual framework of international standards, with a focus on key standards such as revenue recognition, financial instruments, leases, business combinations, and disclosure standards. You can prepare through self-study if you have strong experience or by enrolling in a specialized training program that offers structured explanations and practical applications.

- Take the exam and pass it: The exam lasts for three hours and includes essay-type questions and case studies that assess the candidate’s ability to analyze and apply the standards. The exam is typically held twice a year, and it requires a deep understanding of the standards rather than mere memorization.

- Obtain the certificate after passing: After passing the exam, you will receive the accredited IFRS diploma, which enhances your professional standing in the job market.

To best prepare for the exam, the Macro Development Institute for Training in Riyadh offers one of the best accredited IFRS training programs, designed to help trainees pass the exam with confidence through simplified explanations, practical training on application-based questions, and academic support to deepen your understanding of how to obtain the IFRS certificate and fully benefit from its professional value.

Who is Best Suited for Studying the IFRS Certificate?

The benefits of the IFRS certificate are not limited to a specific group of professionals; they extend to a wide range of workers in the financial sector. The timing of studying for the certificate depends on the nature of your work and career goals. Here are the groups that directly benefit from the IFRS certificate:

- Accountants in both the public and private sectors.

- Auditors and financial reviewers.

- Financial managers and accounting directors.

- Financial reporting analysts.

- Recent accounting graduates.

Each of these groups has different motivations, but the common denominator is the desire to enhance professional competency and advance in their careers. Additionally, studying the IFRS certificate from ACCA is a suitable option for those seeking international recognition that boosts their presence in the market.

Choosing to study this certificate reflects your ambition to expand your knowledge and move from traditional practice to international professionalism, which represents the core benefits of the IFRS certificate in building a sustainable career path.

Job Opportunities After Obtaining the IFRS Certificate

The benefits of the IFRS certificate are clearly evident when looking at the career opportunities it opens for holders, especially in a financial environment that increasingly relies on international standards. Today, companies are not just looking for an accountant who performs daily tasks, but a specialist who understands the global accounting framework and can handle complex financial reports with confidence and efficiency.

Here are some of the key job opportunities available after obtaining the certificate:

- Working as a financial reporting accountant in publicly listed companies.

- Working in large auditing and review firms.

- Taking on the role of a financial analyst specializing in international financial statements.

- Working in banks and investment institutions.

- Advancing to leadership positions such as financial manager or head of the accounting department.

These opportunities reflect an important practical aspect of the benefits of the IFRS certificate, as it allows you to compete in a market that demands high accuracy and advanced knowledge of international standards. The IFRS certificate from ACCA also adds an international dimension to your career, making it easier to transition between local and global companies.

Why Choose Macro Development Institute for Training for IFRS Certificate Courses?

When considering benefiting from the IFRS certificate, choosing the right training provider plays a pivotal role in your success. The Macro Development Institute for Training offers carefully designed training programs to help students pass the exam confidently and gain a deep understanding of the standards. The institute stands out for several reasons, making your educational journey more professional:

- Official accreditation from the General Authority for Technical and Vocational Training.

- Accreditation from the National Center for E-Learning.

- Specialized trainers with practical experience in applying international standards.

- Training content that combines theoretical explanations with practical applications.

- An interactive learning environment that supports discussion and real-life case analysis.

These advantages enhance the benefits of the IFRS certificate when studied within a well-structured training framework. The course goes beyond explaining the standards, offering practical training that helps you understand application-based questions and adequately prepare for the exam.

By choosing the right training provider, you increase your chances of fully benefiting from the IFRS certificate and make your investment in time and effort more effective.

Start today by taking a significant step toward enhancing your professional path and register for the IFRS Certificate course at Macro Development Institute for Training to benefit from a professional training program that supports you until you pass the exam confidently and gain the maximum benefit from the IFRS certificate.

Frequently Asked Questions

Is the IFRS certificate difficult?

The difficulty level depends on your accounting background and commitment to studying, but understanding the standards deeply makes passing the exam and benefiting from the IFRS certificate more practical.

How long does it take to study for the IFRS certificate?

The duration depends on the training program and weekly study hours, typically ranging from a few weeks to several months, depending on your preparation plan.

Is the IFRS certificate from ACCA recognized in Saudi Arabia?

Yes, the IFRS certificate from ACCA is widely recognized and is a strong addition to your resume, especially in companies that apply international standards.